Franchise Questions

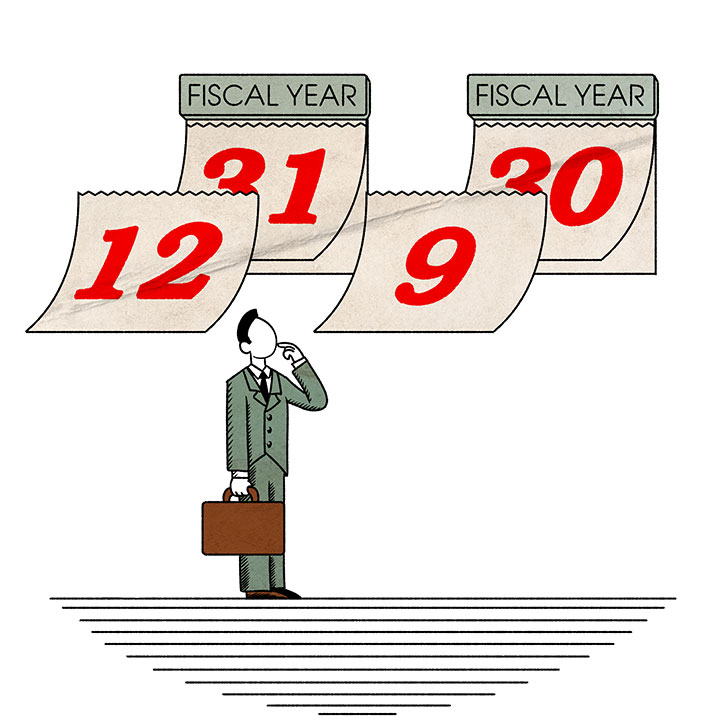

Choosing a Fiscal Year End for Your Franchise Company: September > December

Many things can affect your ability to sell franchises: territory availability, qualified leads, price, infrastructure, etc. What you might not realize is that the fiscal year end of the franchise company also makes this list.

Most companies use a December 31st fiscal year end. Franchisors are no different.

Here’s the potential problem with doing this in franchising: franchising and fiscal years are intertwined. Your FDD and most state registrations will expire within 90 to 120 days after your fiscal year end. This means you would have to do an annual update to your FDD (Franchise Disclosure Document) in the Spring. Keep in mind the update process isn’t just about revising the FDD. In addition:

- You will need audited financial statements included in your FDD; and

- As you expand your brand, you will most likely need to do state filings.

If you have a September 30th fiscal year end, you will be doing all of this in December or January. Why does this matter? It is easier to find a CPA for you audit in December than March because you are not competing with tax filings. Your franchise attorney is more likely to be available in December rather than March (unless there is snow in Colorado and they are on the slopes).

Perhaps the biggest advantage of a September 30th fiscal year end is for state filings. Over a thousand franchisors will be filing registrations or renewals in March and April every year. Franchise registration states have limited capacity to review applications. In some states it can take several months to obtain a registration permit.

Translation: you will have to wait patiently until it’s your turn in line.

The time where you are not allowed to sell franchises while you wait for your state registration (what we call franchise dark periods) can impact your sales. Imagine not being able to sell to a prospect in New York or California for 6 months because your FDD is still waiting to be reviewed – yikes! Because Franchisors with a September 30th fiscal year end file ahead of the crowd, they jump to the front of the line. This can significantly cut down on their wait time and dark periods.

This is why we recommend that franchisors adopt a fiscal year end of September 30th (or another date, like June 30) to avoid the gridlock that comes with updating and filing in March and April. As an added bonus, December and January tend to generally be slower for franchise sales teams, making them the perfect time to spend working on your FDD updates!

As always, if you any questions at all, feel free to contact us here.