Franchise Your Business

How much does it cost to franchise a business?

You have a successful business that can be replicated and have decided it is time to franchise. Great! Now how much will this cost you?

The cost to franchise your business will depend on what franchise assets you already have (trademarks, operations manuals), the franchise suppliers that you choose, and how much of the heavy lifting you will do yourself.

Generally, it will cost between $27,000 and $129,000 to franchise your business. Some of these costs are legal expenses, and some are business expenses. Here is a breakdown of the estimated costs for the items you will need to franchise your business:

1. Franchise Disclosure Document (FDD)

The FDD is the primary legal document used to franchise a business in the United States. It has 23 “Items” about the franchised business and exhibits (including the franchise agreement). For more information on FDDs, check out “What is an FDD”

The FDD is usually offered at a flat fee and can range from $20,000 to $35,000. This is paid to your lawyer.

2. New Legal Entity (Company) for the Franchisor

You will generally want to create a brand-new legal entity (usually an LLC or corporation) for the franchisor that is separate from the entity that owns corporate stores. This is important to help protect your assets. It will also help keep your audit costs down (see #5 below). Additionally, you may also want to create a separate legal entity that will own the intellectual property and license it to the franchisor legal entity. You should have your accountant give you advice on how best to structure the companies for tax purposes.

The cost for setting up these entities will depend on which state you will be forming in, how many owners you have, and whether you have existing operating agreements that can be used for the new entities. These costs will generally be between $500 to $7,500. This is paid to your lawyer.

3. Federal Trademarks; Intellectual Property

As a franchisor, one of your primary roles will be to grant a license to use your intellectual property. “Intellectual property” includes things like your trademarks and your business system. Your intellectual property is also one of your most valuable assets. Because of this, you will want to make sure that it is protected. If you don’t already have a federal trademark for your business, you will want to apply for one early in the franchise process (it can take over a year to get a federally registered trademark). You will want a minimum of two trademarks, one for the name of the business and one for the logo. You’ll also need to ensure that your intellectual property is owned correctly and determine if you need additional protections (like a license agreement between related entities). Trademark fillings will generally cost between $1,500 to $3,500. This is paid to your lawyer and to the United States Patent and Trademark Office for filing fees.

4. Operations Manual

The operations manual is the instruction book for the franchisees. It will contain the system standards of the franchise system (including a list of the approved suppliers and description of the policies and procedures of the franchised business). The operations manual also provides guidance on the operations of franchised business. This can be printed, a digital file, or an interactive website (that may include videos or other multimedia tools). You may initially use an operations manual that you had developed for your corporate store(s), buy a template that you complete, or hire a company to write the entire manual. The costs for your operations manual will depend on which options you choose (e.g. use an existing, buy a template, outsource, paper, electronic) and generally range from $0 to $20,000. Any costs for an operations manual will be paid to the vendor.

5. Audited Financial Statements

The federal franchise law requires that you have audited financial statements for the franchisor entity (remember that these audited financial statements are for the franchisor company, and this is different than financial information that may be included in Item 19 which only describes franchised or corporate owned locations). There is an exception for a franchisor for their first year offering franchises that allows them to use unaudited financial statements. However, unaudited statements are not accepted by California, Minnesota, New York, and Virginia (California requires that any financial statements used in California must, at a minimum, be reviewed by an accountant). If you are going to offer franchises in these states, you will have to have the opening balance sheet audited. An audited balance sheet for a new franchisor entity will cost between $2,000 to $3,000. This is paid to your auditor.

For more information on the required financial statements, check out our blog:: Required Financials for Your FDD

6. Website

You should already have a website that provides information about the products and services of the business. Now you will need a separate website, or a section/pages on your current website, that provides information about the franchise opportunity. This will include information on a franchise prospect’s required qualifications, investment information, information on why a prospect should buy your franchise, and contact information for the franchise department. The costs will depend on whether you will modify your current website or create a new and separate website and will generally cost between $3,000 to $30,000. This is paid to your vendor.

Unless your business already has multiple locations, you will need to update your primary products and services website to allow for multiple locations. This could be a single page for each location or a smaller version of the main website for each location. The cost varies based on your existing website platform and setup and will generally be between $0 and $10,000. This is paid to your vendor.

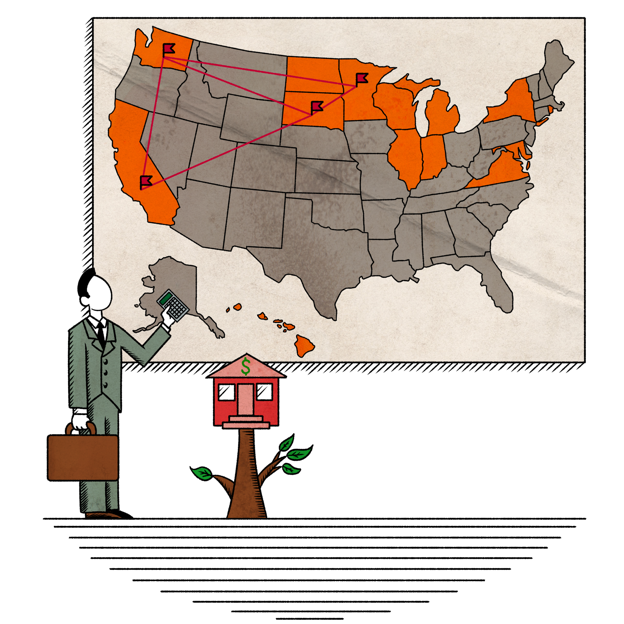

7. State Registrations

In addition to the federal law that governs franchise sales, many states have their own laws that you must comply with if you want to sell franchises in these states.

There are 14 states that require you to register your Franchise Disclosure Document before you can sell a franchise in that state (and file annual renewals):

California, Hawaii, Illinois, Indiana, Maryland, Michigan, Minnesota, New York, North Dakota, South Dakota, Rhode Island, Virginia, Washington, and Wisconsin.

There are two states that require franchisors to file annual Business Opportunity exemptions: Florida and Utah.

There are four states that require a franchisor to file a one-time Business Opportunity exemption: Connecticut, Kentucky, Nebraska, and Texas.

Registration fees for these states range from $25 to $750 and legal fees can range from $750 to $3,000 per state. Your initial franchise costs will depend on where you want to register and can range from $0 (no state registrations) to $20,000 (all states). This is paid to your lawyer and to the states for the filing fees.

Visit here for more information: Registration State Process

8. Optional Items

Franchise Development Consultant

While your franchise lawyer can help you complete the franchise legal documents, you may want to hire a franchise development consultant to help guide you with business and supplier decisions to support development for your franchise launch. The cost will depend on the individual consultant and the amount of consulting needed to prepare a concept specific franchise development program for you and your staff. Costs typically range from $5,000 to $30,000. This is paid to your consultant.

Franchise Sales Brokers

Finding that first (and second, and third…) franchisee can be challenging. Generally, the first few franchise sales are the hardest and most expensive. You may choose to outsource your franchise sales and hire a franchise sales broker. Franchise sales brokers generally take a percentage of the initial franchise fee (typically 50% to 60%) and some may also require an upfront payment (ranging from $2,000 to $50,000) and/or a monthly retainer ($5,000 to $10,000 per month) to pay for sales leads. This is paid to the franchise sales brokers.

Franchise Management Software

How will you track your franchise sales activities? Will you use an Excel spreadsheet? Will you have an intranet for franchisee communications? There are many different software options available that will help you track and manage key elements of the franchise relationship. The costs will depend on the vendor and modules that you choose. This is paid to your vendor.

Marketing Collateral

Your franchise business is awesome. You know it. How do you get everyone else to know it? Time for some franchise swag. Do you need brochures to hand out at the corporate stores and at trade shows? Cool stickers? The cost will depend on what materials you develop and can generally run between $0 to $2,500. This is paid to your vendor.