Franchise Your Business

The Registration States and the Registration Process

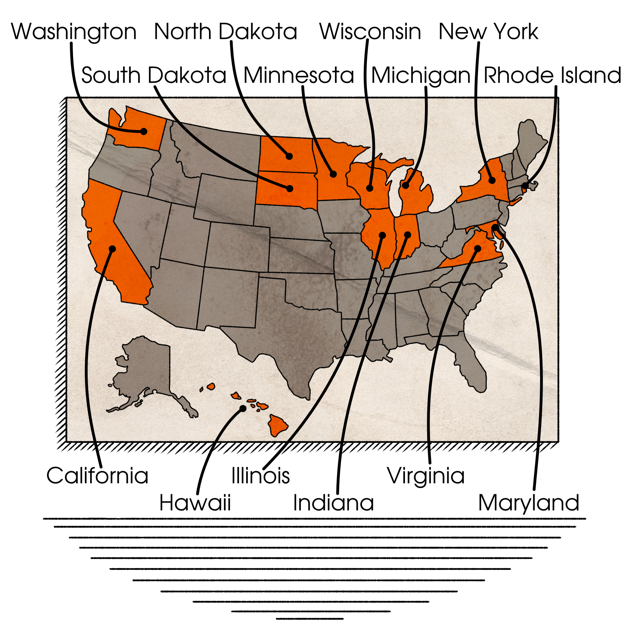

There are 14 registration states that require you to register and annually renew your franchise documents (with the regulators in those states) before you can offer and sell a franchise in that state:

California, Hawaii, Illinois, Indiana, Maryland, Michigan, Minnesota, New York, North Dakota, South Dakota, Rhode Island, Virginia, Washington, and Wisconsin.

To register, you must complete an application (and have it notarized) and send it to the states along with your Franchise Disclosure Document (FDD) and Franchise Agreement (FA). Remember, this means that you need to have your FDD and FA in final form before you start the registration process.

The process for renewing in these states is similar, except that when you file a renewal, you must include a blackline document showing what changes you have made to your FDD and FA from your last registration. These states will also review your website and franchise offering, so make sure your website is compliant before you register in these states!

Many of these states will review and comment on both the FDD and FA and require changes in these documents before they will register your franchise.

Comment Letters

After you submit your registration application, the states will generally review the documents (some more than others) and issue comment letters. “Comment letters” are documents that the regulators prepare and send back to you. These comment letters may ask questions and/orrequire certain changes. The comments are generally based on compliance with federal and state laws. Sometimes examiners request changes based on personal perceptions of fairness and reasonableness, relying on “anti-fraud” statutes or simply requiring the change as a “condition of registration.” The nature and volume of comments varies from state to state and can even vary from examiner to examiner within states (generally between 0 to 60 comments). The regulators’ job is to protect the person who will be buying the franchise, and they take their jobs seriously.

Once the franchisor receives a comment letter, the franchisor will need to respond within a certain time to the regulators – usually by updating the FDD or FA, answering the regulators questions, or even making financial assurance (as described below).

What does all this mean for franchisors? It means that issuing the FDD and submitting applications is often just the beginning of a long process to register to sell franchises in registration states. Most registrations take 2-4 months and can take up to 6 months depending on the state (we are looking at you, New York). This involves waiting to hear back from the regulators, responding to the first comment letter, and then sometimes having additional rounds of comments (if the regulators aren’t satisfied with the franchisor’s initial responses). Every once in a while, we will see an FDD that doesn’t receive a comment letter in one state, but this is pretty unusual. If the franchisor decides that they don’t want to follow the regulators requested changes, then the franchisor can choose not to continue with its registration in that state. But that means that the franchisor can’t make sales in that state.

We’ve made a list below of some of the most common areas and specific comments that the regulators send comment letters on:

Financial Condition and Risk Factors

The most frequent comment is one that addresses the regulators’ concern that the franchisor doesn’t have the financial resources necessary to carry out its obligations under the franchise agreement. So, the regulator imposes a “financial assurance”. Basically, this means that the regulator is requiring the franchisor to provide some protection to the franchisee based on its financial condition (see our blog about financial assurances Franchise Financial Assurance Options). This comment will often be worded like this:

“Due to the franchisor’s lack of financial resources and operating history, the Division will require the impound of franchise fees or an acceptable alternative arrangement.”

In connection with the financial assurance and other issues, states often require franchisors to add risk factors to the FDD. This type of comment will often be worded like this:

“On the State Cover Page, include the following risk factor: The franchisor is at an early stage of development and has a limited financial resources and operating history. This franchise is likely to be a riskier investment than a franchise in a system with greater financial resources and a longer operating history.”

“On the State Cover Page, please remove any risk factor not required by another examiner. Please provide the examiner name and the date of the request for each.”

Fee Calculations and Other Fee Details

The more complex and detailed the franchise offering is, the more you can expect to receive comments. For example, if you have complex fee structures (like discounts, multi-unit fees, fees not paid after the second or third outlet, optional fees, etc.), you can expect to receive comments like this:

“We note that Item 6 states that the continuing royalty may vary for non-traditional locations. Please revise Item 6 to provide more information regarding under what circumstances the fee will vary.”

“We note that Item 6 states that the securities offering fee will be the greater of: (a) a nonrefundable fee equal to 50% of our then-current Initial Franchise Fee; or (b) our reasonable costs and expenses associated with reviewing the proposed offering. Please explain how this provision complies with state law.”

“In Item 7, please describe the factors, basis, and experience considered or relied upon in formulating the estimate for [Item 7 line item].”

Financial Performance Representations (or Earnings Claims)

The financial performance representations are in Item 19 – this is where the franchisor can choose to give financial information about their franchised and corporate locations. If a franchisor is sued, this is often the first section that the franchisee’s lawyer will look at. This is an important section for state regulators too. In recent years, we’ve seen regulators send comments which go “above and beyond” the federal requirements or even change positions from year-to-year. This means that when you prepare the information for Item 19, you can try your best based on the information you have, but it’s very difficult to avoid comment letters based on this section. Regulators often send comments like this:

“For Item 19, add to the table the number and percentage of outlets that met or exceeded the median.” (Statistically, the median is the number such that 50% of the variables always exceed the median)

“We note that the franchisor has only included financial information for outlets that have been operating for more than 18 months, creating a subset of mature outlets. Please explain the franchisor’s reasonable basis for providing financial information based on information from only mature outlets or revise the information to include all outlets that have been operating for more than one year.”

Superfluous Disclosure Requests

The franchise regulations are very specific: you must include exactly what is required (you have to include everything), but you are not permitted to include any other information. We frequently get comments asking franchisors to disclose things in the FDD that are already disclosed. There isn’t much that can be done to avoid getting these comments because they are simply a result of the examiner not reading the FDD carefully.

“Please disclose in Item 1 whether or not the franchisor has any predecessors.”

(Item 1 already states: “We have no predecessor or parent entities.”)

We also receive comments telling us to delete information that is superfluous. For example, if you have included information about the CEO that is more than five years earlier.

Website and Advertising

State examiners often browse the company website and compare it against information in the FDD:

“We note that the company website lists several locations as ‘Coming Soon.’ Please confirm whether you have sold any franchises in the state prior to receiving a permit to offer and sell franchises.”